April 30, 2025 • By NKOZI KNIGHT

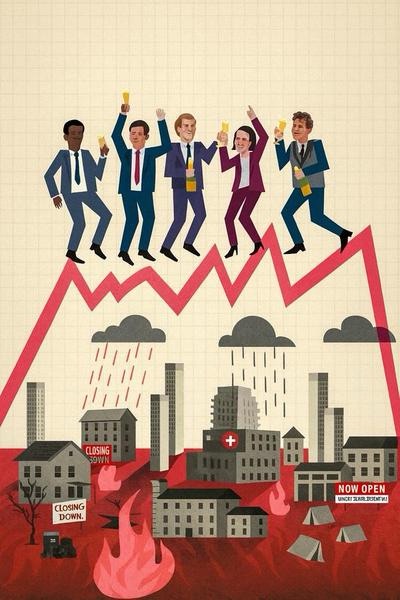

Many of us do not realize that private equity firms has always been about extraction, not creation. The model is simple. Borrow heavily, buy a company, slash jobs and benefits, sell off assets, and walk away with fees long before the damage shows. Communities are left with shuttered stores, abandoned buildings, bankrupt chains, and broken promises.

The list of casualties is long. Toys “R” Us was loaded with more than $5 billion dollars in debt by Bain Capital and KKR before it collapsed, taking 30,000 jobs with it. Payless ShoeSource closed its doors, erasing 18,000 jobs. J. Crew, Gymboree, Shopko, Forever 21, and Sears each followed the same path. Behind nearly every failure was a private equity deal that turned once-profitable companies into vehicles for debt. Blackstone, the largest of them all, drew criticism for gutting nursing homes and rental housing, where residents and tenants bore the consequences. Carlyle, Apollo, and Sycamore Partners engineered deals that enriched executives while leaving behind bankruptcies across retail, energy, and health care.

The damage has never been limited to debt. Private equity firms extract billions in fees on top of what they load onto companies. They sell the land and buildings, forcing the very businesses they own to pay rent back to them. In franchise models, they skim off royalty payments while cutting services and staff. They charge management fees to companies they already control, ensuring that even if a business fails, the firm still profits. These practices are not side effects. They are the business model.

For years the system ran on cheap money. With interest rates near zero, debt was abundant and investors were eager. Firms could buy, bleed, and flip companies in two or three years. That era is gone. Interest rates now sit above five percent. Debt costs more, buyers are scarce, and the IPO market has dried up. Firms are stuck holding companies that are drowning under the very leverage designed to enrich their owners.

The numbers are staggering. Nearly $12 trillion dollars in private equity assets now sit unsold. Exit activity has collapsed more than 70 percent since 2021. To raise cash, firms are borrowing against their own portfolios with NAV loans or dumping stakes at steep discounts on the secondary market. Even the giants like Blackstone, KKR, Apollo, Carlyle, Bain are stuck with bad debt no one wants. They cannot sell, yet their investors are demanding cash.

The quiet truth is that these firms are already maneuvering for Washington’s help. During the 2008 financial crisis, banks and insurers were rescued with taxpayer dollars. Private equity, which profited handsomely off that same collapse, is positioning itself for similar treatment.

This is not just an elite problem. It is a national one. When private equity runs out of road, it is not the billionaire partners who suffer. It is the workers whose jobs are cut, the retirees whose pensions cannot meet obligations, the students whose tuition rises because endowments cannot keep pace, and the taxpayers who are asked to backstop the system.

The parallels to 2008 are frightening. Then it was mortgage backed securities. Now it is unsellable companies and illiquid funds. In 2008, families lost homes and jobs while Wall Street was saved. Today the scale is even larger. With trillions in assets frozen, the next bailout could dwarf the last one.

Meanwhile, private equity’s destruction also extends into America’s hospitals and nursing homes and people are paying with their lives. Studies show that Medicare patients undergoing emergency surgeries in private equity–owned hospitals are 42 percent more likely to die within 30 days compared to those treated in community hospitals . A nationwide study found infections, falls, and other preventable adverse events increased following private equity takeovers of hospitals . Even the U.S. Department of Health and Human Services condemned the impact, warning that private equity ownership of nursing homes led to an 11 percent increase in patient deaths .

Recent reporting shows the financial calculus behind these tragedies. Nursing home operators in New York’s Capital Region diverted Medicare and Medicaid funds through inflated rent and bogus salaries. That left facilities chronically understaffed and suffering neglect so severe that it led to cases of serious injury and death .

By turning hospitals and nursing homes into profit centers rather than care centers, private equity firms aren’t just bankrupting businesses, they are literally killing people. And when that business model collapses, it will be everyday Americans who pay the cost once again.

The message is not subtle. If private equity’s gamble fails, the richest players will once again be saved. For ordinary Americans, the reckoning will look like it always does. Lost jobs. Higher taxes. Vanishing pensions. Rising tuition. And another generation paying for someone else’s greed.

This is the American cycle. The profits are privatized, the losses are socialized, and working families are forced to carry the cost.